BY KELLY THOMPSON

SENIOR ACCOUNT EXECUTIVE, BENEFITS

As the cost of healthcare and employee benefits continues to rise, employers are open to creative and unique ways to maximize employee offerings in a cost-effective way. There are multiple solutions that we provide to our clients including, but not limited to:

- Health Reimbursement Accounts

- Flexible Spending Accounts (Medical and Dependent Care)

- Health Savings Accounts (with qualified High Deductible Health Plans)

Offering these additional benefits allows employees to save on their out-of-pocket costs and enhances the employee benefits packages at a minimal cost. These benefits, along with their core benefits such as Medical, Dental, Vision, Life and Disability, will improve the employee’s experience at your company.

Health Reimbursement Accounts (HRAs) offer a way for employers to offset the out-of-pocket expenses for their employees while reducing the company’s insurance premium on the medical plan. If a company changes their medical plan to increase the deductible or out-of-pocket maximum in order to decrease the premium, then the company can offer a Health Reimbursement Account to each enrolled employee that would reimburse the higher deductible or out-of-pocket maximum so the employee cost share remains the same.

Health Reimbursement Accounts are very flexible in how they are implemented and the vendor would work directly with the employees to reimburse the claims.

Flexible Spending Accounts (FSAs) are used to withhold pretax money from the employee’s paycheck to use for medical or dependent care expenses. The 2022 contribution limit is $2,850 for the Health/Medical FSA and $5,000 for the Dependent Care FSA. These plans are also administered by vendors that will process the claims reimbursement directly from the Flexible Spending Accounts back to the employee, many times with a debit card. These accounts are often known as “use it or lose it” benefits, and there are some options that allow a carryover benefit to the new plan year. There are also Commuting benefits such as transit and parking passes that may be available.

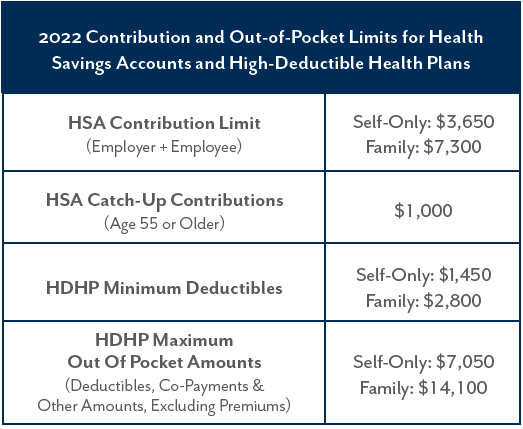

Health Savings Accounts (HSAs) are only available to those who are enrolled in a qualified High Deductible Health Plan. Health Savings Accounts offer employees tax-free savings through payroll deductions or by using an outside bank for their HSA. The biggest difference between the HSA and FSA is that the HSA money belongs to the employee in their own bank account and the money is not forfeited at the end of the year. The funds in the Health Savings Accounts can be used for medical expenses, prescription drugs, dental, vision, and other expenses based on the IRS guidelines. Similar to the FSA, there is a contribution limit associated with the HSA, and the 2022 limitations for the HSA contribution and deductible amounts are listed in the chart below:

https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/2022-fsa-contribution-cap-and-other-colas.aspx

https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/irs-2022-hsa-contribution-limits.aspx