BY KELLY THOMPSON

SENIOR ACCOUNT EXECUTIVE, BENEFITS

As highspeed internet has become more common in the United States and abroad, medical health professionals have partnered with insurance carriers to hone the craft of virtual medical visits. What began as a promising experiment to complement traditional doctor visits, has found itself as a mainstay in an increasingly virtual economy. Virtual health visits and telemedicine have been on the rise in recent years which allowed providers time to troubleshoot, and work on the dynamics to expand capacity prior to the pandemic.

For many years now, providers have been entering into the virtual space to serve their patients more efficiently. Some of the most common telemedicine visits are for convenience so members can remain in their own home for conditions that could be diagnosed on video such as pink eye, dermatological services or certain cold and flulike symptoms, while other services like ear infections and utilizing in-office or laboratory testing would require a visit to an office.

As technology has progressed and virtual meetings have become more common, healthcare professionals have been able to provide a safe, cost effective, efficient way to evaluate patients and prescribe medications as an alternative to traveling to a provider’s office. This is especially convenient if care is required after hours where an urgent care or emergency facility would otherwise be utilized. The cost of a virtual visit is often lower than the primary care or specialist’s cost, and certainly more cost-effective compared to urgent care or the emergency department.

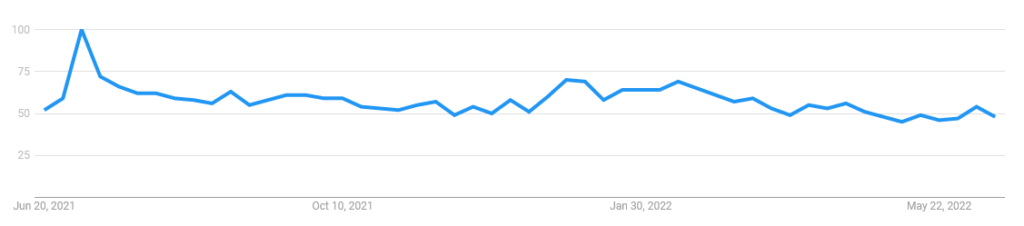

Google Trends tracks interest in topics over time by tracking the search terms entered into Google’s search engines. The graph below represents the Google Trend for telemedicine over the last two years. Though somewhat anecdotal, the graph below clearly indicates a spike in interest in June 2021, followed by a sustained roughly threefold increase in interest over the previous normalized search interest.

Many medical insurance carriers are offering virtual visits as an embedded or low-cost service within the major medical coverage. Some carriers even offer certain visits at no cost to the employee. For those with High Deductible Health Plans (HDHPs) where all non-preventive services apply toward the deductible, carriers offer a maximum telemedicine cost without being subject to the deductible, which creates a more patient-focused healthcare model. Typically, virtual health visits are available without a previously scheduled appointment and can be relatively on-demand by being available within minutes rather than long wait times typically experienced at a brick-and-mortar facility. Additionally, the wait time is served in the comfort of one’s home. There are other third-party companies that offer their telemedicine services at a lower out of pocket cost for an employer-paid benefit to all eligible employees and dependents. Some of those services also work with physicians and registered nurses that will visit the home.

Telemedicine is also a convenient option for those who work remotely or reside in rural areas where it is not as convenient to visit a provider’s office. It also provides patients access to online specialist visits sooner while many in-person provider’s office visits may be fully scheduled weeks in advance. Telemedicine can typically connect members to mental health and nutrition services as well. More telemedicine services are available with the use of a mobile app or a smart phone rather than being at a computer.

The Bottoms Group is on the leading edge of telemedicine and stands ready to discuss virtual visits or other telemedicine options. Whether your virtual visits are embedded in a major medical policy or standalone, always feel free to reach out to see what service is the best option for your group.