By David Bottoms, REBC, RHU, CLU, ChFC

President

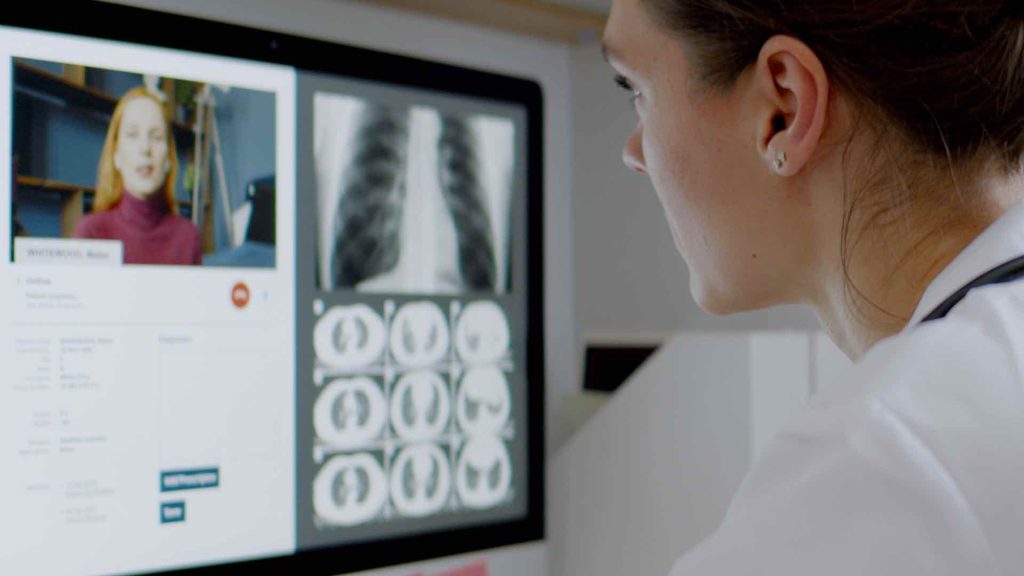

Over the course of the past two years, and by virtue of necessity given COVID-19, healthcare consumers have gotten a crash course in the use of telehealth platforms to engage with healthcare providers via virtual means.

During the early days of the COVID-19 pandemic, as lockdowns were in full effect and even many doctor’s offices were shuttered, telehealth utilization soared such that, per health records company, Epic, 69% of physician “office visits” during the month of April 2020 took place via a virtual care platform.

In the months that have followed, virtual visit utilization has dropped significantly; however, it still stands well above pre-pandemic levels which raises an important question of what role telehealth will have in the United States’ healthcare delivery system in the years ahead. The answer to this question is an important one for health care providers, insurers, and employers who are charting their respective strategic courses for the years ahead.

For healthcare providers and systems, an integrated and effectively marketed virtual care platform has the potential to increase engagement with patients while enabling the health system to ensure continuity and coordination of care within its own healthcare ecosystem. This approach could result in downstream financial benefit for providers while also creating efficiencies and improved health outcomes for patients given that, with an integrated, provider-based platform, there is consistency of provider/patient relationships, electronic medical record maintenance, etc.

In particular, given that primary care and behavioral health matters continue to represent the lion’s share of telehealth utilization while concurrently representing bottle necks in the traditional care delivery system, opportunities abound for the development of hybrid (virtual/in-person) service models to meet patient needs in an efficient and sustainable manner.

For insurers, telehealth has potential to introduce newfound efficiencies to the health care delivery system as a result of the fact that, for instance, in 2021, the average reimbursement amount paid for a telehealth “office visit” was $119; whereas, the average reimbursement amount paid for an in-person evaluation and management (E&M) office visit with a similar purpose was $174.

Additionally, many insurers see telehealth as an opportunity to integrate their own preferred telehealth platforms directly into health plan designs to reduce incremental “office visit” costs while providing opportunity for referral management and steerage to lower cost or “higher quality” providers for specialty and procedural care in an effort to reduce overall health care spend.

In fact, one needs to look no further than the growth of “virtual-first” health plans to see how insurers such as Humana, United Healthcare and other well-known players are positioning themselves to play a significant role in the front-end of the healthcare delivery system. In these programs, members have access to no-cost virtual care for initial, non-emergency provider discussions and, then based upon the referrals from the virtual care physician, members can seek in-person care from in-network specialists for more complex issues, lab testing, etc. These plans effectively use a customer-friendly spin to reintroduce the “gatekeeper” role that insurers have historically played in an effort to develop lower cost coverage options for individual health care purchasers and employers sponsoring group benefit plans.

Of course, telehealth has its limits. For pediatric care, the lower potential for patient communication among other obvious limiting factors renders telehealth often less than ideal for children. Similarly, on the other end of the age spectrum and given the increased prevalence of chronic health issues and comorbid conditions in older adults, telehealth efficacy is debatable for older adults.

Nonetheless, working age adults constituted roughly 70% of telehealth utilization in 2021 and, as such, health care providers, insurers, and employers would be wise to keep their eyes on the signals consumers are sending with respect to virtual health care preferences and calibrate their strategies to align lest they find themselves outmaneuvered by competitors more acutely focused on this new frontier.